University of York: Venture One

A venture philanthropy fund supporting enterprise for all

In the wake of the devastation of the Covid-19 pandemic, the University of York is asking: how can we best support enterprise and innovation to build back better, drive innovation, economic growth and social change?

At York, we are inspiring a culture of enterprise in the region to combat disadvantage, retain our diverse talent and advance productivity and competitiveness for the benefit of all.

As part of our ambition to support more students and recent graduates in their business startups, we have launched Venture One - a ground-breaking venture philanthropy initiative aimed at providing start-up capital for new businesses alongside intensive training, mentoring and business-growth support.

Venture One matches the inspiration of philanthropy with the rigour of investment. After a successful pilot, we are now inviting donors to help us build the fund to reach more entrepreneurs and their ideas, resulting in the creation of new businesses from students, staff and recent alumni and creating a powerful social and economic impact in the region and beyond.

UNIVERSITIES AS A DRIVER FOR GROWTH

The student population has the potential to drive the UK’s boom in self-employment – since 2008 there has been a 66% increase in the number of 16- to 29-year-olds going freelance. But just 1% of freelancers learnt about self-employment in school or college and 2% in university, according to ComResresearch.

A 2018 Santander survey reports that in the UK:

- Over 450,000 students currently run a business whilst at university

- Student enterprises collectively generate revenues of £1 billion a year

- A third plan to turn their business into a career when they graduate

To thrive in the modern world, Britain’s next generation must be adaptable to change. Up until relatively recently, a job for life was both possible and preferable. It’s increasingly neither. Universities have been central to many of the great intellectual revolutions across history – now they must embrace enterprise education to imbue students with the necessary enterprising skills to flourish in the twenty-first century.

INNOVATION AT YORK - OUR SUCCESS

York already has a strong track record of supporting students in the creation and development of new business ideas.

Our international network of alumni entrepreneurs provide inspiration to current students and we are proud to maintain a close relationship with many of our most successful alumni business leaders.

Bethany Watrous

Experience Heritage delivers immersive and interactive heritage displays, digital models, web and mobile apps and modified images for heritage groups, museums and private owners using the latest digital technologies. Bethany Watrous, the company’s founder and lead Digital Archaeologist, graduated from York in 2018 and has been building up the business, based in York, with the support of her team since then.

Bethany is a member of Phase One, the University of York’s incubator programme which provides entrepreneurs the time, space and support to start, grow and develop their business. Experience Heritage was a national finalist in the Santander Emerging Entrepreneurs Awards in 2020.

Bethany Watrous, Founder of Experience Heritage

Bethany Watrous, Founder of Experience Heritage

Toby Cannon

Myles is a business with the mission of making fitness fun for all. They provide a platform for organisations to run fun and effective virtual fitness challenges, so they can support employees with their wellbeing, team building or fundraising.

The support the University of York offers to entrepreneurs is fantastic. The funding we’ve received will allow us to validate our product in a new market. The mentorship, advice and resources that Chris and the team provide have really helped set Myles up for success in both the short and long term. I initially developed Myles to maintain motivation levels after my first marathon was postponed. We’ve grown the platform over the past year and have been able to secure multiple high profile clients. The Venture One fund will allow us to build on our corporate offering and validate a new corporate package."

Isabella Lee

Elxr is on a mission to become the UK's leading natural and sustainable skin hygiene brand. Back in early 2020, co-founders Amelia and Isabella identified a significant lack of high quality, skin-friendly sanitiser on the market when the world was in desperate need. They created a sustainable solution using local ingredients and reusable bottles- revolutionising the way we clean our hands on-the-go.

The duo is currently introducing Elxr to various retailers and developing a wider product range. Since first release, their launch product has been hailed "the best sanitiser we've found" by TATLER magazine, praised by notable figures such as the founders of Pebble magazine and Naturisimo and gained a community of cult buyers on social media.

Co-founder Isabella Lee, a former Business Management student at the University of York, describes how the Venture One programme has helped their business:

Venture One has given us the ability to market to audiences we wouldn't have been able to reach without investment. It has also given us room to iterate on and test out future products. The board's collective expertise and insights have been incredibly valuable, helping us to rework our commercial model and sell to larger retailers that otherwise would have been near impossible to target.

BUSINESS START UP AT YORK: THE JOURNEY FROM IDEAS TO GROWTH

1. Ideation, validation, proof of concept:

By: UG and PG students, research students, professional service staff, alumni (up to 5 years after graduation)

2. Early Support

E.g. Enterprise Skills Development, Start-up Support including summer accelerator programmes, a Year in Enterprise, mentoring and advice

3. Phase One: Incubation

Start-up space and enterprise ecosystem offered free for up to 12 months, including a programme of advice/mentoring and access to professional service partners

4. Venture One: Advanced Subscription

Initial investment, typically in the form of advanced subscription for the development of an MVP, with a value of c. £10,000. Access to ongoing advice and mentoring programmes

5. Venture One: Seed Funding

If the business meets pre-set criteria for further investment, the University would be able to exercise a right to invest up to a cumulative aggregate Fund investment in an individual company of c. £50,000.

6. Successful Businesses Growth

Continuation of mentoring and support, participation in accelerator programmes, investment return to the Fund

VENTURE ONE: HOW THE FUND WORKS

Venture One is a venture philanthropy “fund” created by the University with the support of donors. The Fund provides investment capital for the creation, development and early-stage growth of innovative business concepts generated by the University community (students, recent alumni and staff). The fund is designed to facilitate the development of an MVP or the gathering of evidence of market demand, by offering between £5-10,000 in advance subscription or seed funding.

Two-stage investment model

Advanced subscription: The first investment in a new company would typically be in the form of an advanced subscription with a value of c. £10,000. Advanced subscription would give the University future rights to equity in the business - effectively acting as pre-payment for shares that would be allocated in a future funding round. Advanced subscription would be supported by a standard Advanced Subscription Agreement, and investment would be conditional on the investee company’s acceptance of the Fund’s standard terms.

Seed funding: If the business meets pre-set criteria for further investment, the University would be able to exercise a right to invest up to a cumulative aggregate Fund investment in an individual company of c. £50,000. Normally such investments would be made on the basis of an equity investment round led by a third-party investor, and on that investor’s terms and conditions i.e. the Fund would not lead an investment.

Venture One welcomes applications from:

- current students of the University of York, both undergraduate and postgraduate

- recent alumni, typically up to three years from graduation

- members of University staff, where the business idea does not directly relate to current research

Investment governance and management

Governance: All funds are held and managed by the University. Investments are made using criteria in alignment with the University’s charitable purposes. A Fund Board has been created, with University members and external members, to advise the University on the strategic direction of the Fund, and to make robust and timely decisions about individual investments.

Management: A Fund management function has been created with responsibility for identifying potential investment opportunities (based on criteria established by the Fund Board), supporting applicant businesses through the investment process and monitoring the performance of the portfolio.

Evergreen investment model & scale-ability

The ultimate intention will be to route all returns on investments to the Fund, in order that the Fund can keep investing in new businesses, thus creating an evergreen investment model. The “Fund” will not be a fund in the FCA sense. It is a ring-fenced pool of University-derived and donated capital that is deployed by the University in a fund-like way but in line with the University’s charitable purposes. Shareholdings in individual businesses as they arise will be owned by the University, and in the event of disposals/exits, the returns are returned to the Fund.

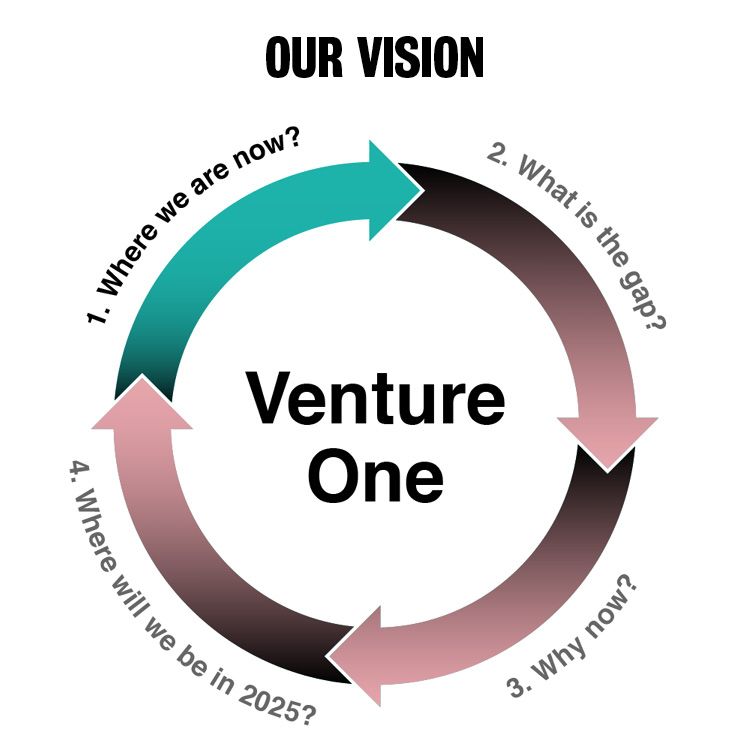

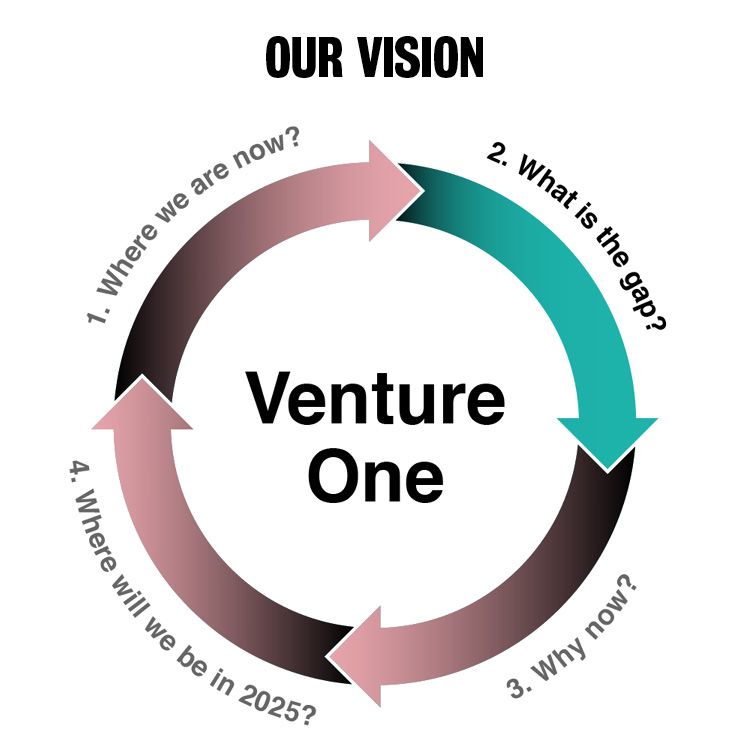

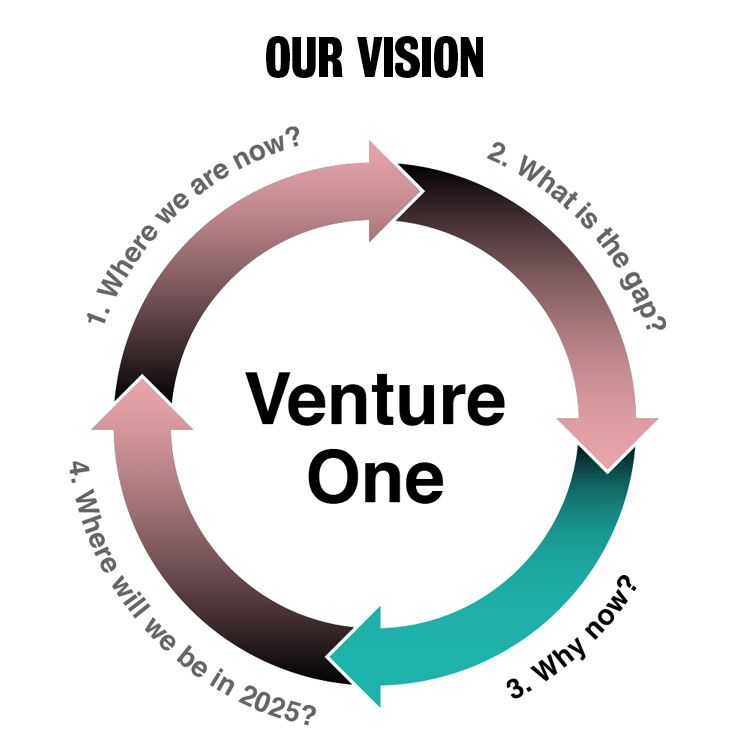

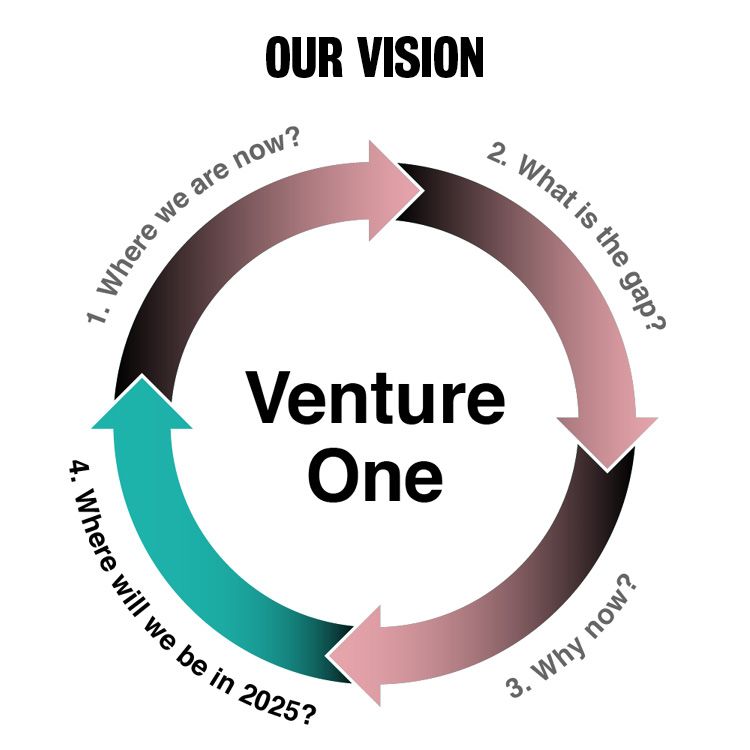

1. Where are we now?

Our current offer introduces students to the concept of entrepreneurship, stimulates their interest and then provides focused support for start-up activities.

This comprises:

- Enterprise Skills Development courses, Bespoke start-up Support

- Year in Enterprise / summer accelerator

There is significant potential to grow the number of students we are reaching.

2. What is the gap?

Our current offer provides a strong level of support for students and recent graduates in the process of developing their skills and enthusiasm in start up to a point where pre-investment preparations are appropriate.

Venture One has been developed to bridge the gap by introducing some capital investment and more intensive support for business at the stage of launch and growth, thus supporting the wider ecosystem for business creation.

After a successful pilot, now we want to scale up and grow the Venture One Fund.

3. Why now?

University investment in The Institute for Enterprise and Leadership and the York Accelerator Programme, together with incubation facilities at Phase One and the new Guildhall development, are all building capacity in the enterprise ecosystem at York to support economic growth and prosperity.

York Unlimited has highlighted the important contribution philanthropy is making to nurturing entrepreneurial talent, with donors such as Santander already pledging their support for Venture One.

After a successful pilot, it’s now an ideal time to scale up and grow the Venture One Fund.

4. Where will be in 2025?

The Fund will have been a catalyst for the creation of new businesses in York for creating economic and social benefit across the region and beyond.

The University will be known for high-performance enterprise and innovation, having developed a flourishing eco-system for start-ups which investors look to for bright ideas to solve future challenges.

IMPACT

Individual: Individuals & teams applying for/receiving investment funding will benefit from an intensive programme of entrepreneurial skills development and practical support during the early stages of their company’s growth.

Alumni and supporters of the University in the UK and overseas will benefit from an enriching opportunity to engage with student and staff enterprise.

Economic: Creation of new businesses and employment opportunities, innovation and growth, in York and the wider region.

Strengthen the University’s ecosystem around enterprise support, working with the York Accelerator Programme, Phase One and the Guildhall incubation programmes, and the wider network of local and regional professional service sector.

Societal: Potential for investment stimulating business creation with societal goals (e.g. sustainability, provision of products and services with a health benefit, inequality and social justice).

Support for inclusive Enterprise for all programmes within the Institute for Enterprise and Leadership, with a culture of enterprise that is combatting disadvantage, training our diverse talent and advancing productivity and competitiveness for the benefit of all.

Focus on encouraging beneficiaries from the fund to ‘give back’ e.g. by sharing skills with young people, volunteering and building links with local community organisations.